Who should obtain GST Registration?

On the basis of the turnover limit

| A person dealing with the supply of | Turnover limit |

|---|---|

| Goods (other than special category States) | exceeds Rs.40 lakhs |

| Services (other than special category States) | exceeds Rs.20 lakhs |

| Goods or services in Special Category States | Exceeds Rs.10 lakhs |

Mandatory Registration irrespective of Turnover

- Persons making any inter-State taxable supply

- Casual taxable persons making taxable supply

- Persons who are required to pay tax under reverse charge

- Non-resident taxable persons making taxable supply

- Persons who are required to deduct tax under GST Act

- Agent of the registered person

- Input Service Distributor

- persons who supply goods or services or both through such electronic commerce operator

- Every electronic commerce operator

- Every person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered person

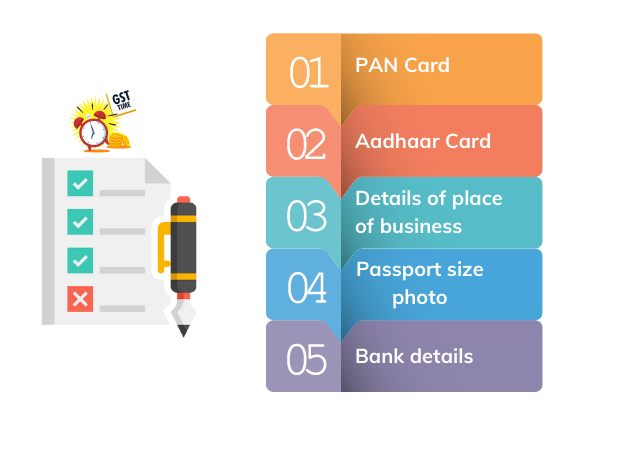

Documents required for GST Registration

- Pan of the Applicant

- Aadhar Card

- Identity and Address proof of Promoters/Director with Photographs

- Letter of authorization/ Board Resolution for Authorized Signatory

- Address proof of the place of business

- Bank Account statement/Cancelled cheque

- Proof of business registration or Incorporation certificate

- Digital Signature